The global fingerprint sensors market is estimated to be valued at US$ 11.46 Bn in 2025 and is expected to reach US$ 24.88 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 11.7% from 2025 to 2032.

To learn more about this report, Request sample copy

Key Takeaways:

Market Overview:

The global fingerprint sensors market is growing rapidly due to rising demand for secure, convenient biometric authentication. Optical fingerprint sensors are expected to dominate with a 52.8% share in 2025, driven by affordability and ease of use. Touch fingerprint sensors will hold 57% market share, fuelled by widespread adoption in connected devices. The BFSI sector leads in usage, accounting for 43.6%. North America will dominate regionally with 42% share, supported by advanced infrastructure and strong regulatory support for biometrics.

Current Events and its Impact on the Fingerprint Sensors Market

|

Current Event |

Description and its impact |

|

Increased Demand for Contactless and Secure Authentication |

|

|

Expansion of National ID and e-Governance Programs |

|

|

Technological Innovations in Fingerprint Sensing |

|

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Fingerprint Sensors Market Pricing Analysis

The pricing structure of the global fingerprint sensors market in 2025 is influenced by several factors, including sensor type (optical, capacitive, and ultrasonic), integration level (in-display, side-mounted, rear-mounted), production scale, and end-use application.

Prices remain moderately competitive, especially in the consumer electronics sector, where high volumes drive cost efficiencies. Optical sensors are generally the most cost-effective, while ultrasonic and in-display variants command premium pricing due to enhanced accuracy and integration complexity.

Premium pricing is observed for advanced fingerprint sensor technologies, particularly those with under-display integration, 3D sensing capabilities, and enhanced security features such as hardware encryption. These high-end sensors are commonly adopted in flagship smartphones, biometric payment systems, and automotive applications, where performance and user experience are critical. OEMs and enterprises are willing to invest more in these advanced modules to ensure security, device miniaturization, and seamless user interfaces.

Regional pricing disparities continue, with North America and Western Europe experiencing higher average costs due to strict privacy regulations, advanced hardware requirements, and demand for customized solutions. In contrast, Asia Pacific, led by manufacturing hubs in China, Taiwan, and South Korea, benefits from cost-effective mass production and economies of scale, keeping unit prices lower and supporting broader adoption across mid-range consumer devices.

Role of Emerging Technologies in the Fingerprint Sensors Market

Emerging technologies are reshaping the fingerprint sensors market by enhancing security, accuracy, integration, and user experience across applications. Innovations such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), edge computing, and advanced biometric algorithms are driving the evolution of fingerprint sensing solutions.

AI and ML are being integrated into fingerprint recognition systems to improve pattern recognition, reduce false positives, and enable adaptive learning for multi-user authentication. These intelligent systems are especially valuable in high-security environments like banking, government, and healthcare, where accuracy and real-time threat detection are critical.

Edge computing is enabling faster fingerprint data processing directly on devices, reducing response time and enhancing data privacy by minimizing cloud dependencies. This is particularly useful in mobile and wearable devices, where low latency and secure authentication are essential.

Additionally, the rise of in-display fingerprint sensors, ultrasonic scanning, and flexible biometric modules is transforming product design in consumer electronics, enabling seamless integration into foldable devices, smart cards, and automotive control panels. Advanced materials and miniaturization are making sensors more durable and energy-efficient, further boosting adoption.

Together, these technologies are not only expanding the scope of fingerprint sensors beyond traditional access control but also reinforcing their role in next-generation authentication, digital identity, and contactless ecosystems.

Fingerprint Sensors Market Trends

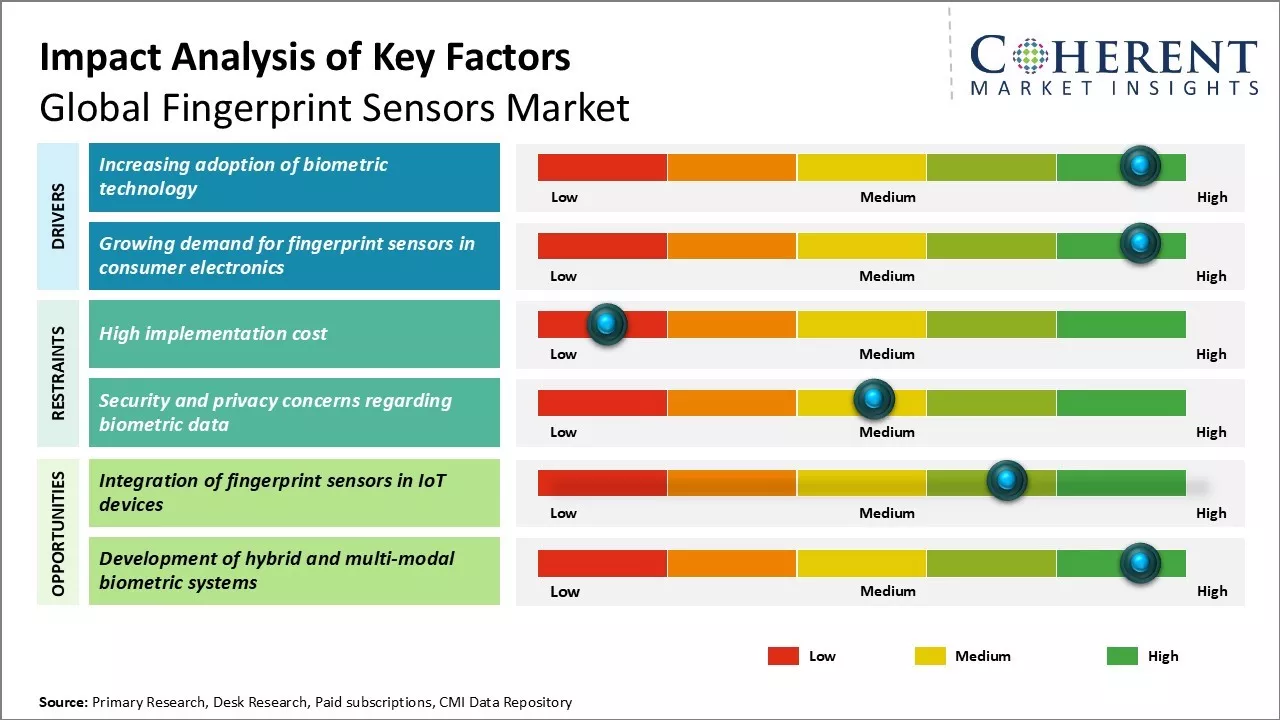

Increasing adoption of biometric technology

The adoption of biometric technology has been rising rapidly in recent times due to increased focus on security and convenience. Biometric authentication provides a hassle-free identification method for users without the need to remember passwords or pins. Fingerprints have emerged as one of the most popular and widely used modalities for biometric identification due to their uniqueness and ease of capture.

Fingerprint sensors have enabled quick and seamless biometrics-based login for millions of smartphone, laptop, and desktop users globally. As people store more sensitive personal and financial information online, there is a growing need for secure authentication methods to protect unauthorized access. Fingerprint biometric provides a much stronger layer of security compared to traditional password or pin-based systems which are prone to hacking.

Major technology companies now include fingerprint sensors as standard features in their flagship devices recognizing the consumer demand for embedded biometric security. In June 2024, The Times of India reported that the Realme GT 6, launching in India on June 20, will feature an in-display fingerprint scanner as part of its flagship specifications. This underscores the continued trend of embedding biometric authentication in mid-to-high-end smartphones.

Fingerprint sensors have carved a dominant niche for themselves in the smartphone market and this success is fuelling their integration into various other consumer electronic devices as well. Smartphone makers led the way by bundling front and back mounted fingerprint readers in their flagship phones over the past few years. As biometrics grew popular among consumers to unlock phones, technology entrepreneurs spotted avenues to apply this convenience factor beyond mobiles.

Smart televisions and home appliances now offer fingerprint authentication for secure payment acceptance and parental controls. Wearable’s like smart watches are also fitting fingerprint sensors to avoid passcodes for payments and unlocking companion phone apps. As the PC segment battles increased security risks, laptop and desktop models have commenced including fingerprint biometrics for frictionless login, data protection and access to BIOS settings. Even gaming consoles are experimenting with fingerprint sign-in as a hygienic alternative to controllers.

Opportunities in the fingerprint sensors market

Integration of Fingerprint Sensors in IoT Devices

The increasing integration of fingerprint sensors into various internet of things (IoT) devices and applications presents a lucrative opportunity for the fingerprint sensors market. With the proliferation of connectivity across end-points, there is a rising need for strong yet user-friendly authentication systems to ensure cyber security and access control. Fingerprint biometrics provide a convenient and secure solution owing to their accuracy and scalability.

IoT domains like smart home security systems, wearable’s, smartphones, automotive, banking, and healthcare are opting fingerprint sensors for user identification, device unlocking, and digital payments. This growing dependency on fingerprint verification in IoT ecosystems would spur extensive demand for low-cost, compact sensors with enhanced capabilities.

Mass IoT adoption could further encourage sensor miniaturization and integration into smaller devices. Overall, the convergence of fingerprint biometrics and IoT is expected to play a pivotal role in driving the revenues of fingerprint sensor vendors in the coming years.

Fingerprint Sensor Market Insights, By Type

The optical fingerprint sensors segment is projected to account for 52.8% of the fingerprint sensors market share in 2025. This dominance is primarily attributed to the convenience and user-friendliness of optical sensors, which operate by capturing detailed images of fingerprint patterns through a light source and prism system. Their widespread use in consumer electronics, especially smartphones and laptops, continues to drive market growth due to their cost-effectiveness, ease of integration, and reliable performance.

Fingerprint Sensor Market Insights, By Technology

The touch fingerprint sensors segment is expected to dominate the market with a 57.0% share in 2025. The rapid proliferation of internet-connected devices, including smartphones, wearables, and IoT platforms, is fuelling demand for seamless and secure biometric authentication.

Touch-based fingerprint technologies deliver high-speed, accurate identification and offer an intuitive user experience, making them a preferred choice in both personal and enterprise digital ecosystems.

Fingerprint Sensor Market Insights, By Vertical

The Banking, Financial Services, and Insurance (BFSI) sector is anticipated to contribute 43.6% of the fingerprint sensors market share in 2025. This growth is driven by the need for robust identity verification mechanisms amid rising digital fraud and regulatory compliance requirements. The integration of fingerprint sensors into ATMs, mobile banking applications, and fintech platforms enhances both user convenience and transaction security, underscoring the sector’s growing reliance on biometric solutions.

Fingerprint Sensors Market: Regional Insight

To learn more about this report, Request sample copy

North America Fingerprint Sensors Market Analysis and Trends

North America is expected to maintain its leading position in the global fingerprint sensors market, capturing a projected 42.0% share in 2025. This dominance is driven by a robust technological infrastructure, early adoption of biometric authentication solutions, and widespread integration of fingerprint sensors across consumer electronics, enterprise systems, and public sector applications.

The region has seen significant investments in cyber security and digital identity management, particularly within the government, healthcare, and BFSI sectors. Regulatory frameworks such as the Biometric Information Privacy Act (BIPA) in the U.S. have spurred demand for secure and privacy-compliant fingerprint solutions. Moreover, the rise of mobile banking, contactless payment platforms, and smart devices is accelerating the deployment of fingerprint sensors across North America.

Continuous innovation from regional tech giants and sensor manufacturers is also strengthening the market, especially in advanced areas such as under-display and ultrasonic fingerprint sensors. With increasing emphasis on data protection and user authentication, North America remains a key driver of global market growth in fingerprint sensing technology.

Distributed Fingerprint sensors market Dominating Countries:

United States, Canada

The United States, Canada, Germany, and China are the leading contributors to the global fingerprint sensors market, reinforcing regional dominance through innovation, regulatory backing, and technological adoption.

The United States leads the market, backed by its advanced technological ecosystem, early integration of biometric systems in government and enterprise security, and strong presence of key fingerprint sensor manufacturers. Regulatory initiatives like the Biometric Information Privacy Act (BIPA) and increasing demand for secure digital identity systems are further driving adoption across sectors such as healthcare, BFSI, and public services.

Market Report Scope

Fingerprint Sensors Market Report Coverage

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 11.46 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 11.7% | 2032 Value Projection: | USD 24.88 Bn |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: |

Apple Inc., CrucialTec, Egis Technology Inc., Fingerprint Cards AB, Goodix Technology, IDEX Biometrics, Invixium, M2SYS Technology, NEXT Biometrics, Novatek Microelectronics Corp., Qualcomm Technologies, Inc., Synaptics Incorporated, Touch Biometrix, Vicharak, and VKANSEE |

||

| Growth Drivers: |

|

||

| Restraints & Challenges: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Analyst Viewpoint – Fingerprint Sensors Market

Fingerprint Sensors Market: Key Development

Market Segmentation

Sources

The Stakeholders Consulted:

Databases Opened:

Scientific and Industry Journals:

Newspapers & Media Outlets:

Associations and Regulatory Bodies:

Public Domain Sources:

Proprietary Research Elements:

Share

Share

About Author

As an accomplished Senior Consultant with 7+ years of experience, Pooja Tayade has a proven track record in devising and implementing data and strategy consulting across various industries. She specializes in market research, competitive analysis, primary insights, and market estimation. She excels in strategic advisory, delivering data-driven insights to help clients navigate market complexities, optimize entry strategies, and achieve sustainable growth.

Missing comfort of reading report in your local language? Find your preferred language :

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients

US Reciprocal Tax Impact Analysis On Fingerprint Sensors Market

Stay updated on tariff changes with expert insights and timely information