Global Humira Market Size and Forecast – 2025 – 2032

The Global Humira Market is projected to be valued at USD 4.68 Bn in 2025, but is expected to decline to USD 1.20 Bn by 2032, experiencing a negative compound annual growth rate (CAGR) of -17.6% from 2025 to 2032.

Key Takeaways of the Global Humira Market

Market Overview

The Humira market is expected to experience a significant downward trend during the forecast period. This decline can be attributed to the increasing competition from biosimilars, as Humira's patent protection has expired in several major markets. Additionally, the advent of novel therapies targeting similar indications is also contributing to the market's contraction. As healthcare systems seek cost-effective alternatives, the adoption of biosimilars and newer treatment options is likely to accelerate, putting pressure on Humira's market share and overall growth prospects.

Current Events and Its Impact

|

Current Events |

Description and its impact |

|

Emergence of New Biosimilars |

|

|

Enhancing Patient Access Programs for Humira |

|

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Humira Market Insights, By Indication - Rheumatoid arthritis (RA) dominates the market due to its high prevalence and the well-established efficacy of treatment options

Based on indication, the Rheumatoid Arthritis (RA) segment is estimated to contribute the highest share of the market with 25.2% in 2025 owing to several key factors. Firstly, the increasing prevalence of RA worldwide has significantly contributed to the growth of this segment. RA is a chronic autoimmune disorder that causes inflammation, pain, and stiffness in the joints, primarily affecting the hands, wrists, and feet. The rising incidence of RA, particularly in developed countries, has led to a higher demand for effective treatment options like Humira.

For instance, in February 2025, according to a study published in National Library of Medicine, the global burden of rheumatoid arthritis (RA) has increased in terms of incidence and prevalence between 1990 and 2021, while mortality rates have declined. The age-standardized incidence rate rose from 10.4 to 11.8 per 100,000 population, and the age-standardized prevalence rate increased from 182.5 to 208.9 per 100,000 population.

Moreover, Humira's proven efficacy in managing RA symptoms and slowing disease progression has made it a preferred choice among healthcare professionals and patients alike. Its ability to reduce joint damage, improve physical function, and enhance the overall quality of life for RA patients has further solidified its position as a leading treatment option in this segment.

Humira Market Insights, By Gender – Male Segment Dominates Due to Higher Prevalence and Severity of Certain Autoimmune Conditions Like Ankylosing Spondylitis

Based on gender, the male segment is projected to contribute the highest share of the Humira market with 54.2% in 2025, due to several underlying factors. In March 2023, according to a study by Global Autoimmune Institute, men are more likely to be diagnosed with certain autoimmune disorders, such as Ankylosing Spondylitis (AS) and Psoriatic Arthritis (PsA), which are effectively treated by Humira. The higher prevalence of these conditions among men has naturally led to a greater demand for Humira in this demographic.

Moreover, men are generally more prone to engaging in physically demanding activities and occupations, which can exacerbate the symptoms of inflammatory disorders. This increased exposure to physical stress and strain has contributed to a higher need for effective treatment options like Humira among the male population.

Humira Market Insights, By Formulation - Prefilled Pen Segment Dominates Due to Patient-Friendly Autoinjector Design and Enhanced Comfort

In the global Humira market, the prefilled syringe segment has emerged as the dominant segment, accounting for a significant majority of prescriptions—estimated at over 80.5% of total patient usage in 2025. This strong preference is driven by the pen’s user-friendly autoinjector design, which simplifies self-administration, particularly for patients with rheumatoid arthritis and other chronic inflammatory conditions. The prefilled pen also offers enhanced patient comfort, especially with newer citrate-free, high-concentration formulations, which reduce injection pain and improve adherence. While the prefilled syringe remains available, it is generally reserved for patients who require manual control or have specific clinical needs. The widespread adoption of the prefilled pen reflects a broader shift toward patient-centric drug delivery systems that prioritize ease of use, treatment consistency, and improved outcomes.

Reimbursement Scenario

Regional Insights

To learn more about this report, Request sample copy

North America Humira Market Analysis and Trends

North America, holding a market share of 37.3% in 2025, is expected to dominate the global Humira market. The region boasts a robust healthcare infrastructure, high patient awareness, and favorable reimbursement policies, which have contributed to the widespread adoption of Humira. The presence of AbbVie, the manufacturer of Humira, in the U.S. has further solidified the region's position. AbbVie's strong distribution networks and marketing strategies have played a crucial role in maintaining Humira's market leadership. Additionally, the region's well-established regulatory framework and intellectual property protection have provided a conducive environment for the growth of the Humira market.

In May 2020, AbbVie, a global biopharmaceutical company known for its leadership in immunology, hematologic oncology, and neuroscience, successfully completed its acquisition of Allergan. This acquisition, approved by all relevant authorities, positions AbbVie as a diversified leader in therapeutic areas such as immunology (Humira), oncology (Imbruvica), and aesthetics (Botox). The deal expands AbbVie’s portfolio, driving its growth platform to approximately USD 30 billion in 2020 revenues, with combined revenues reaching exactly USD 50 billion.

Asia Pacific Humira Market Analysis and Trends

Asia Pacific is projected to exhibit the fastest growth in the global Humira market, holding a market share of 25.3% in 2025. The region's rapid economic development, increasing healthcare expenditure, and the rising prevalence of autoimmune diseases have fueled the demand for Humira. Countries such as China, Japan, and Australia have witnessed significant market growth, due to expanding patient populations and improving access to advanced therapies. Moreover, governments in the region have implemented policies to streamline drug approval processes and enhance healthcare infrastructure. Also, the entry of biosimilars in certain Asian markets has also contributed to increased competition and affordability, driving the adoption of Humira and its alternatives in the region.

Global Humira Market Outlook for Key Countries

U.S. Humira Market Trends

The U.S. Humira market remains a key player in the global landscape, benefiting from a large patient population, high healthcare spending, and a favorable reimbursement environment. AbbVie’s strong presence and extensive marketing efforts have helped maintain Humira’s position in the country. However, with the impending patent expiration of Humira, biosimilar manufacturers are increasingly entering the market, which could lead to significant shifts in market dynamics. The introduction of lower-cost biosimilars is expected to put pressure on Humira’s market share, despite the ongoing clinical research and development efforts aimed at expanding its indications and improving patient outcomes.

China Humira Market Trends

The Humira market in China is undergoing significant transformation due to the emergence of biosimilars and evolving healthcare policies. Since the expiration of Humira's patent in China, several domestic companies have introduced biosimilar versions, including Tabovi and Junmaikang, which have received regulatory approval from the National Medical Products Administration (NMPA). These biosimilars offer more affordable treatment options for patients with autoimmune diseases such as rheumatoid arthritis and Crohn's disease.

The Chinese government has actively supported the development and adoption of biosimilars through expedited approval processes and inclusion in the National Reimbursement Drug List (NRDL), enhancing their accessibility in both urban and rural areas. Despite these advancements, the uptake of biosimilars remains lower compared to Western countries, attributed to factors like physician and patient hesitancy, concerns over long-term efficacy and safety, and the relatively narrow price difference between originator drugs and biosimilars.

Japan Humira Market Trends

Japan continues to be a significant market for Humira, supported by a well-established healthcare system and a high prevalence of autoimmune diseases. The country’s aging population and increasing healthcare expenditure have historically supported the demand for advanced therapies. AbbVie has collaborated with local partners to maintain its presence in Japan Humira market. However, the market is now facing a decline due to the increasing competition from biosimilars and alternative treatment options. These factors are expected to impact Humira’s market share, leading to a decrease in its position in the coming years.

For instance, AbbVie, in partnership with Eisai and EA Pharma, gained approval for HUMIRA (adalimumab) to treat ulcerative colitis (UC) in adults and pediatric patients. The new high-dose regimen (40 mg weekly or 80 mg biweekly) aims to maintain remission in UC patients, while the pediatric approval introduces a convenient at-home injectable treatment. UC, a chronic condition affecting 220,000 people in Japan, often requires long-term management, with 30% of severe cases needing colectomy.

Germany Humira Market Trends

Germany's market for Humira has been supported by a robust healthcare infrastructure, high patient awareness, and a strong presence of AbbVie. The country’s well-established regulatory framework and reimbursement policies have traditionally facilitated the adoption of Humira. Germany is also a hub for clinical research, with numerous studies conducted to evaluate Humira's efficacy and safety across various indications. However, the market is now experiencing a decline due to the entry of biosimilars and increasing focus on cost-containment measures. These factors are expected to challenge Humira's market dominance and lead to a decrease in its market share in Germany.

Market Players, Key Developments, and Competitive Intelligence

To learn more about this report, Request sample copy

Company Insights

Market Report Scope

Humira Market Report Coverage

| Report Coverage | Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 4.68 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | -17.6% | 2032 Value Projection: | USD 1.20 Bn |

| Geographies covered: |

|

||

| Segments covered: |

|

||

| Companies covered: |

AbbVie Inc. |

||

| Growth Drivers: |

|

||

| Restraints & Challenges: |

|

||

Uncover macros and micros vetted on 75+ parameters: Get instant access to report

Humira Market Dynamics

To learn more about this report, Request sample copy

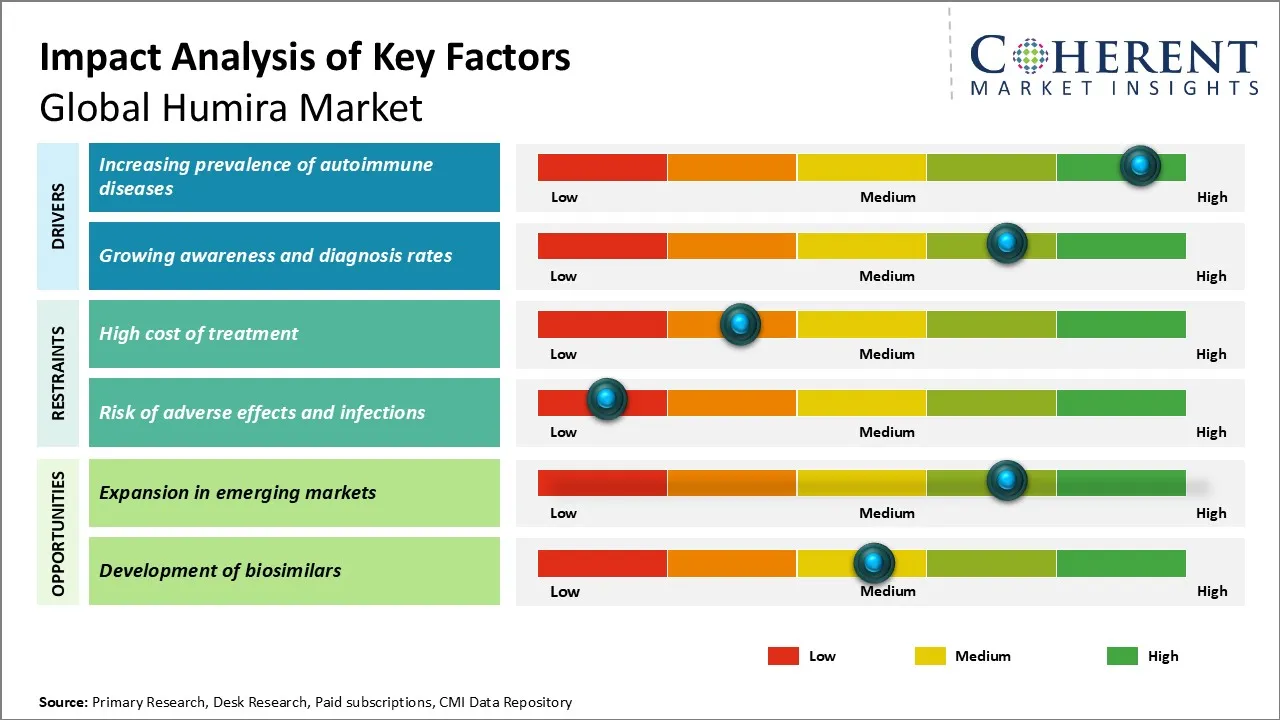

Humira Market Driver - Increasing Prevalence of Autoimmune Diseases

Despite the increasing prevalence of autoimmune diseases worldwide, which has traditionally been a significant driver for the growth of the global Humira market, the market is now experiencing a decline. Autoimmune diseases, such as rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, and Crohn's disease treatment, continue to rise, and Humira, as a TNF-alpha inhibitor, has been a widely used treatment for these chronic conditions. However, the expiration of Humira’s patent and the growing competition from biosimilars and novel therapies targeting similar indications are limiting its growth potential. Although awareness among patients and healthcare professionals about the benefits of biologic therapies like Humira remains high, the increasing adoption of more cost-effective treatment options is expected to significantly reduce Humira’s market share and hinder its expansion in the coming years.

For instance, according to Sjögren's Foundation, in March 2025, autoimmune diseases occur when the body mistakenly attacks its own cells, with over 100 types, including lupus, rheumatoid arthritis, and type 1 diabetes. Around 25% of people with one autoimmune disease develop another. Heredity plays a significant role, as 30-35% of those diagnosed with Sjögren’s have family members with autoimmune diseases. Currently, over 50 million Americans (8% of the population) are affected, and the prevalence is rising. Global studies show a 19.1% annual increase in autoimmune diseases, with conditions like Sjögren’s and lupus seeing a 7.1% annual rise.

Humira Market Opportunity - Expansion in Emerging Markets

The global Humira market has a promising opportunity for growth through expansion in emerging markets. As healthcare infrastructure improves and awareness of autoimmune disorders increases in developing countries, there is a growing demand for effective treatments like Humira. By focusing on these emerging markets, pharmaceutical companies can tap into a significant patient population that has been previously underserved. To capitalize on this opportunity, market players must develop targeted strategies that consider the unique challenges and characteristics of each emerging market.

This may involve collaborating with local healthcare providers, adapting pricing models to ensure affordability, and investing in patient education and support programs. Additionally, establishing local manufacturing facilities or partnerships can help reduce costs and improve supply chain efficiency, making Humira more accessible to patients in these regions. By successfully navigating the complexities of emerging markets, the global Humira market can expand its reach, improve patient outcomes, and drive substantial growth in the coming years.

Analyst Opinion (Expert Opinion)

Market Segmentation

Sources

Primary Research Interviews

Databases

Magazines

Journals

Newspapers

Associations

Public Domain Sources

Proprietary Elements

Share

Share

About Author

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Transform your Strategy with Exclusive Trending Reports :

Frequently Asked Questions

Joining thousands of companies around the world committed to making the Excellent Business Solutions.

View All Our Clients

US Reciprocal Tax Impact Analysis On Humira Market

Stay updated on tariff changes with expert insights and timely information